Nil-Rate Band (NRB) and Residence Nil-Rate Band (RNRB) explained: how to maximise Inheritance Tax relief?

Inheritance Tax (IHT) often represents one of the most significant financial considerations in estate planning within the UK. As a tax levied on the estate (including property, money, and possessions) of someone who has passed away, understanding the mechanisms available to mitigate its impact is crucial for effective financial planning. Two key tools in navigating the complexities of IHT are the Nil-Rate Band (NRB) and the Residence Nil-Rate Band (RNRB).

What is the Inheritance Tax Nil-Rate Band (NRB)?

The Inheritance Tax Nil-Rate Band or NRB is a threshold below which the estate does not incur IHT, effectively allowing a portion of the estate to be passed on tax-free.

In the UK, every person has a Nil Rate Band (NRB) of £325,000. That is, any assets within the NRB threshold are taxed at a nil rate of Inheritance Tax. Subject to certain exemptions and reliefs, the balance is taxed at 40%. Please also note that NRB at death can be reduced by the chargeable value of gifts made by the deceased within the 7 years before their death.

Assets passing between spouses and civil partners are free from inheritance tax; any nil-rate band unused by a spouse is transferred to the surviving spouse and the inheritance tax is deferred to the second death (spouse exemption can be limited where the domicile requirements are not met).

What is the Residential Nil Rate Band (RNRB)?

Introduced on 6 April 2017, the Residence Nil Rate Band RNRB is an additional tax-free allowance and is currently £175,000 per person. However, not everyone can utilise the RNRB. It only attaches to a residence passing to direct descendants, that is, children (including step, adopted and foster children) and grandchildren.

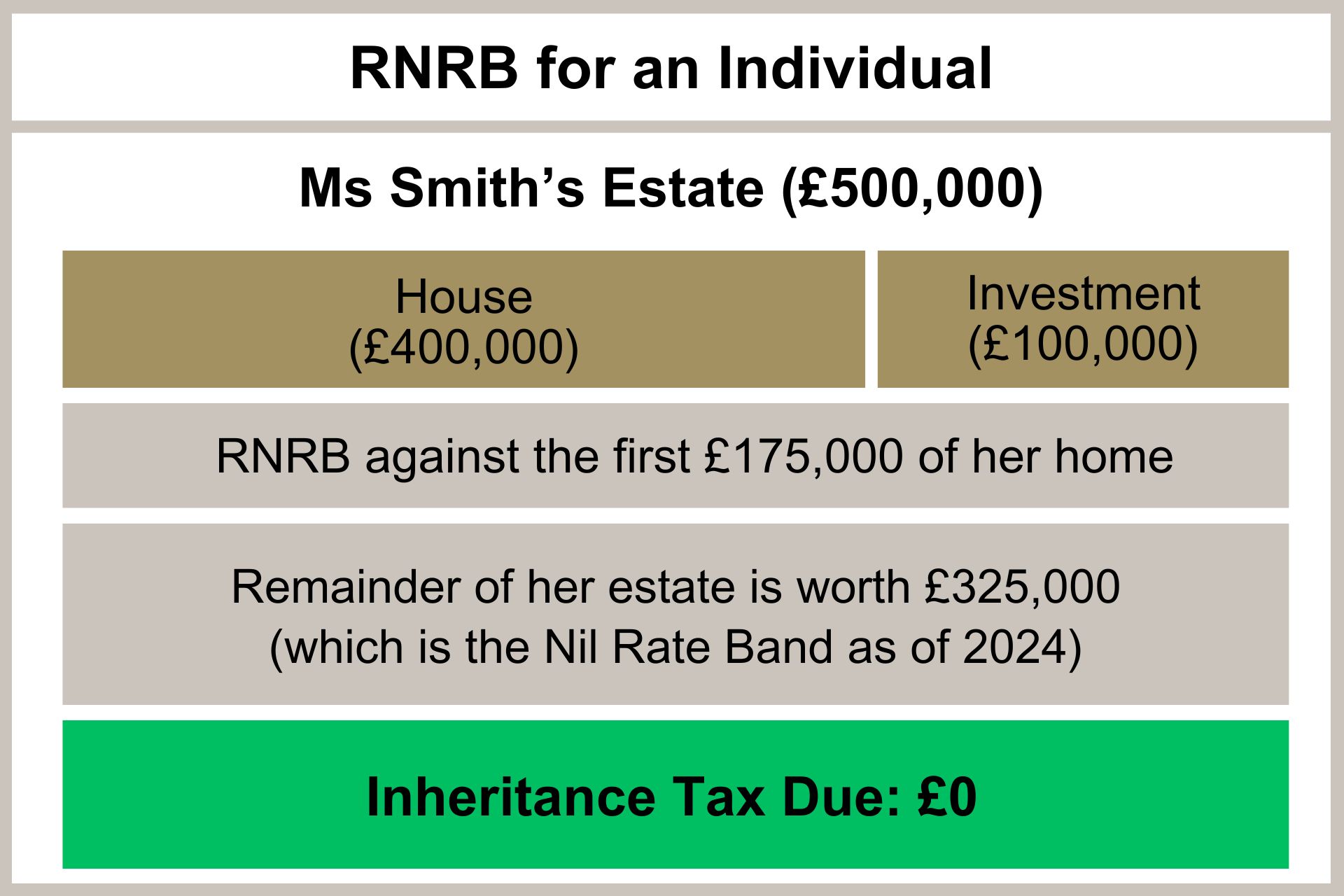

Example of benefiting from RNRB as an Individual:

Ms Smith dies on 10 April 2024. She is a single woman but has a daughter from a previous relationship.

Her estate comprises her property worth £400,000 and cash and investments worth £100,000.

Her executors can claim the RNRB against the first £175,000 of her home which brings down the value of the remainder of her estate to £325,000.

No inheritance tax is due.

Can the Nil Rate Bands be transferred?

Every individual is entitled to their own Nil-Rate Band (NRB) and Residence Nil-Rate Band (RNRB).

For those in a marriage or civil partnership, the remaining portion of the NRB/RNRB that was not utilized upon the demise of the first spouse or civil partner can be passed on to the surviving partner.

This essentially means that if any part of the NRB and/or RNRB remains unused at the time of the first partner’s death, it can be carried over to the surviving partner, to be applied upon their subsequent death.

When HM Revenue and Customs (HMRC) approves a request to carry over any unused NRB and RNRB, the available bands for the surviving spouse or civil partner at the time of their death are augmented by the percentage of the bands that remained unused after the first partner’s death.

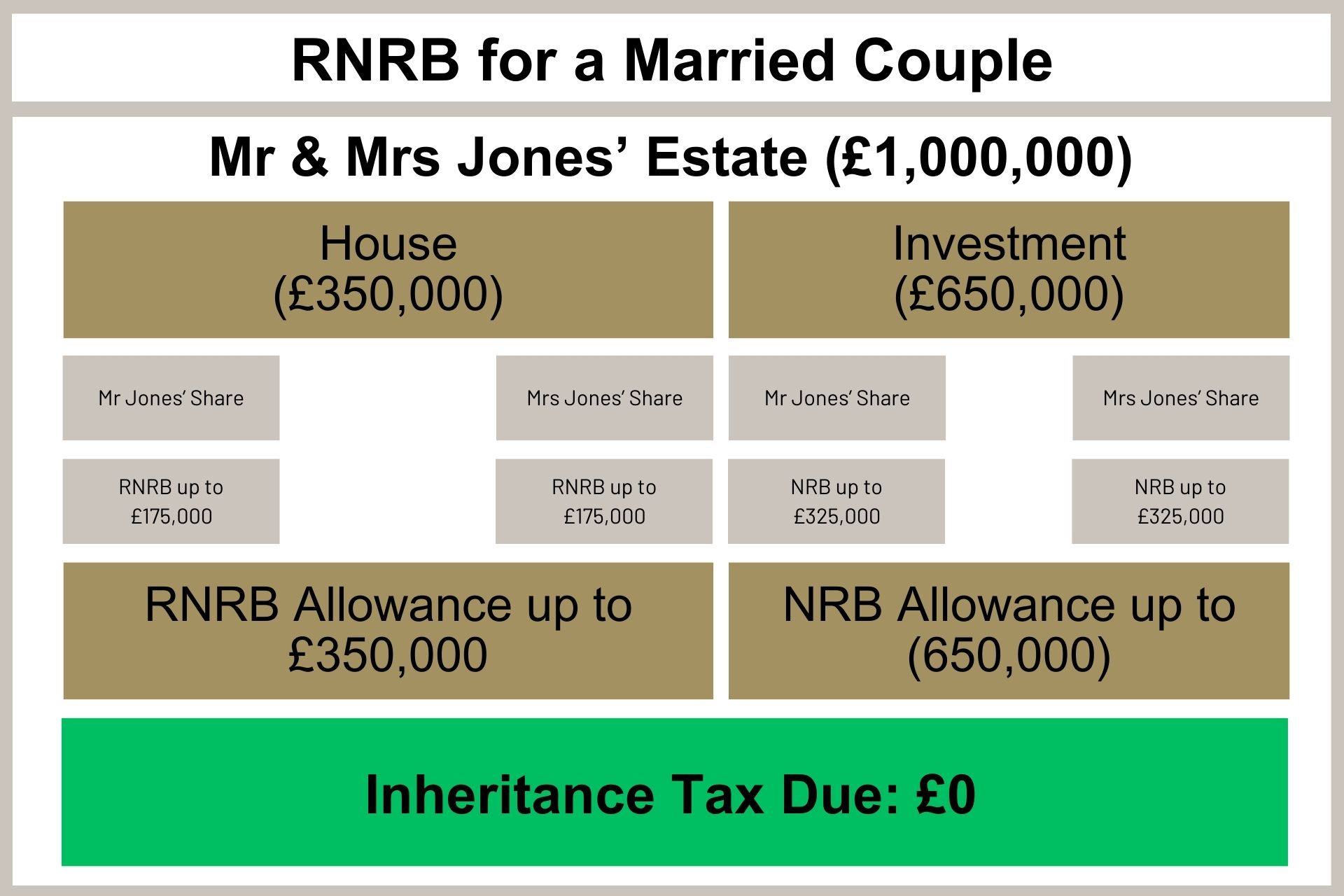

Example of benefiting from RNRB as a married couple:

Mrs Jones dies on 10 April 2024 leaving her estate to her daughter. Her husband had died in 2022 leaving his estate to his wife, which meant that no inheritance tax was due on his death.

However, inevitably this means that the survivor’s estate is worth more. Therefore, on the death of Mrs Jones, her estate comprises her home worth £650,000 and investments worth £350,000.

The executors will be able to deduct both Mrs Jones’ RNRB £175,000 and NRB £325,000, as well as Mr Jones’s unused RNRB £175,000 and NRB also £325,000.

No inheritance tax was due.

Can you claim RNRB benefits if you’ve downsized your property?

Should you reduce the size of your home, no longer own it, or have stopped owning it since 8 July 2015, you can still take advantage of the residence nil rate band if you leave assets of equal value to your direct descendants upon death.

While normally in order to benefit from the RNRB, an individual must leave a residential property to their descendants, individuals can claim the RNRB if they have previously owned a residential property, but no longer own it at the time of their death.

This allows people who have downsized or moved into a care home to benefit from the additional allowance up to the value of the residential property that they previously lived in. These rules are complex and legal or, accountancy advice should be taken.

What are the exclusions from the Residential Nil Rate Band?

- Please note that the exemption for spouses and civil partners only applies specifically to those couples. Therefore, heterosexual, or same sex couples in a long-term relationship will not benefit from the tax-free gift to spouse or civil partner.

- The property must have been the residence of the deceased at some point and so this cannot be applied to buy-to-let properties.

- If an individual has more than one home, only one property can attract the RNRB.

- For estates that exceed £2 million (even if the actual property is worth less than this), the RNRB will be reduced by £1 for every £2 that the estate is valued over £2 million.

- Note that properties which have been left into a trust may not qualify for the relief and therefore we recommend that people review their existing arrangements.

While this allowance is a key part of the tax framework, effective planning often involves a more comprehensive strategy to minimise your estate’s tax liability. For a detailed discussion on how to manage your assets and secure your family’s financial future, you can visit our dedicated Inheritance Tax Planning service page. Our solicitors can also assist with a full range of Wills, Trusts & Estates legal matters to ensure your wishes are legally protected.

FAQs related to Inheritance Tax Nil Rate Band and Residential Nil Rate Band

What if one passes all their assets to their spouse, with provision for children on the second death?

The RNRB can still be claimed by the surviving spouse’s estate executors, transferring it like the NRB. If a spouse leaves a life interest in their estate to their partner, with children inheriting after, both RNRBs can be used if the children inherit directly after the life tenant’s death.

However, the RNRB may not be unavailable if you leave your property in a life interest trust to your partner, to whom you are not married, so that they could live in it for the rest of their life before the share of the property then passes to your children. Therefore, it is crucial to seek legal advice before drafting your Will to ensure direct inheritance for children or grandchildren through careful drafting.

What about if assets are left to children and grandchildren via discretionary trusts?

If assets, including a residence, are left to children on a discretionary trust then the RNRB will not apply, even if the class of beneficiaries is limited to children and grandchildren. However, if specialist professional advice is taken swiftly after death and if the residence is gifted out of the discretionary trust to a direct descendent within 2 years of death the allowance can be used.

Does the RNRB apply to estates of all sizes?

Unfortunately, the RNRB does not apply to estates of all sizes. Larger estates will not benefit from the RNRB. Where an estate is worth over £2 million, the RNRB will be tapered away by £1 for every £2 that exceeds £2 million.

Does the RNRM apply on second properties and to buy to let properties?

Individuals are entitled to a single RNRB regardless of owning multiple properties. Personal representatives must select which residence the relief applies to if there’s more than one eligible. The property must have been a residence of the deceased at any time, not necessarily their main home. The relief still applies if the deceased had moved out, such as into a care home, and rented the property.

Can I give away my property before I die to avoid paying inheritance tax altogether?

Transferring ownership of your house but continuing to live in it without paying market rent (known as a gift with reservation of benefit) means it’s still part of your estate for inheritance tax. To avoid this, you must pay market rent, verified regularly by letting agents, to the new owner. However, giving away your home carries risks, including loss due to the recipient’s potential legal and financial troubles.

If you need legal advice on Inheritance Tax planning and want to speak to one of our Wills, Trusts and Estate experts, you can call us on 020 7940 4060 or email your query at mail@anthonygold.co.uk.

Please note

The information on the Anthony Gold website is for general information only and reflects the position at the date of publication. It does not constitute legal advice and should not be treated as such. It is provided without any representations or warranties, expressed or implied.

Our Latest Wills, Trusts & Estates Insights

- January 29, 2026

Who owns a body after death? The legal principles behind burial rights and human remains

- December 17, 2025

Why professional help matters: Avoiding LPA rejections and protecting your future

- November 22, 2025

Islamic Wills in Non-Muslim Majority Countries Like the UK

- November 22, 2025

Does Marriage or Divorce Affect Your Will? UK Trusts & Estates Solicitor Explains

- November 21, 2025

Assisted dying in the UK: Legal developments and inheritance implications

- November 20, 2025

Funeral wishes and pre-paid plans: Your rights, options and what the law may soon change

Related Guides

Latest Articles

View allInsights: February 13, 2026

Insights: February 13, 2026

Insights: February 12, 2026

Make a payment

Contact the Conveyancing team today

Contact us today

"*" indicates required fields

Contact the commercial

& civil Dispute team today

"*" indicates required fields

Contact the Conveyancing team today

Contact the Conveyancing team today

Contact the Wills, Trusts

& Estates team today

Contact the Court of

Protection team today

Contact the Employment Law team today

Contact the Clinical Negligence team today

Contact the Family & Relationships team today

Contact the Personal Injury Claims team today

Contact the leasehold & Freehold team today

Contact the Corporate & Commercial team today

Contact the housing & disputes team

"*" indicates required fields